Published May 1, 2024

Investing doesn’t have to be limited to buy-and-hold strategies. For investors who are willing to take on additional risk to seek out potentially greater short-term returns than traditional investment strategies, Global X Investments Canada Inc. (formerly Horizons ETFs Management (Canada) Inc.) offers its family of BetaPro ETFs, which provide daily leveraged (up to 2x), inverse (-1x) and inverse leveraged (up to -2x) exposure to 12 different equity and commodity indices.

What are leveraged ETFs and how do they work?

Leveraged and inverse leveraged ETFs are a subset of ETFs typically used by ETF investors with a short-term trading horizon, looking to utilize a higher-risk profile to generate potentially higher short-term returns.

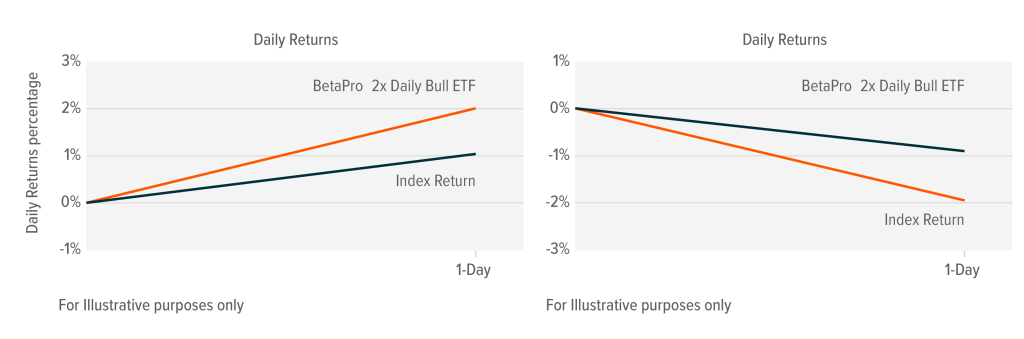

While most ETFs will provide you with the direct performance of the underlying securities held by the fund, one category of ETFs offers investors the opportunity to gain exposure to up to two times, or up to minus two times the daily performance of an index or asset class: The BetaPro Daily Bull and BetaPro Daily Bear ETFs. For a BetaPro Daily Bull ETF with its full 2x leverage exposure, if its underlying index goes up 1% on a day, the BetaPro Daily Bull ETF should gain approximately 2% that day. On a given day, if the underlying index of the BetaPro Daily Bull ETF goes down 1%, then the BetaPro Daily Bull ETF should decline approximately 2% that day.

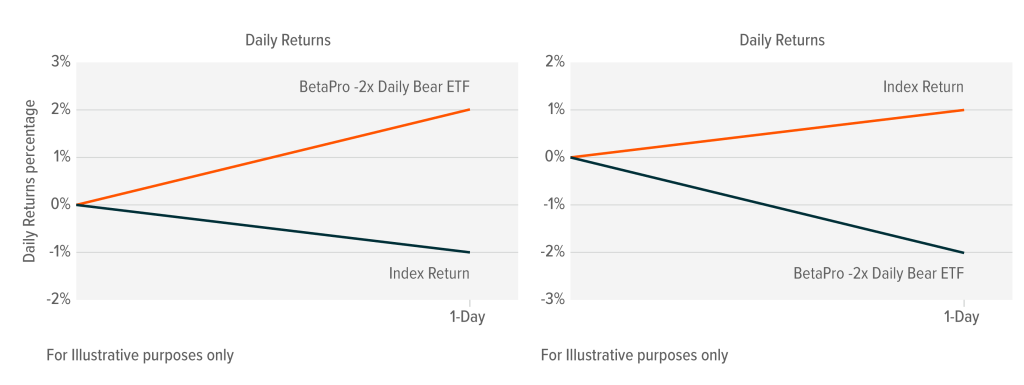

As shown below, for a BetaPro Daily Bear ETF with its full -2x inverse leverage exposure, if the underlying index goes down 1% on a day, the BetaPro Daily Bear ETF should gain approximately 2% that day. If the underlying index of the BetaPro Daily Bear ETF goes up 1% on a day, then that ETF should decline approximately 2% that day.

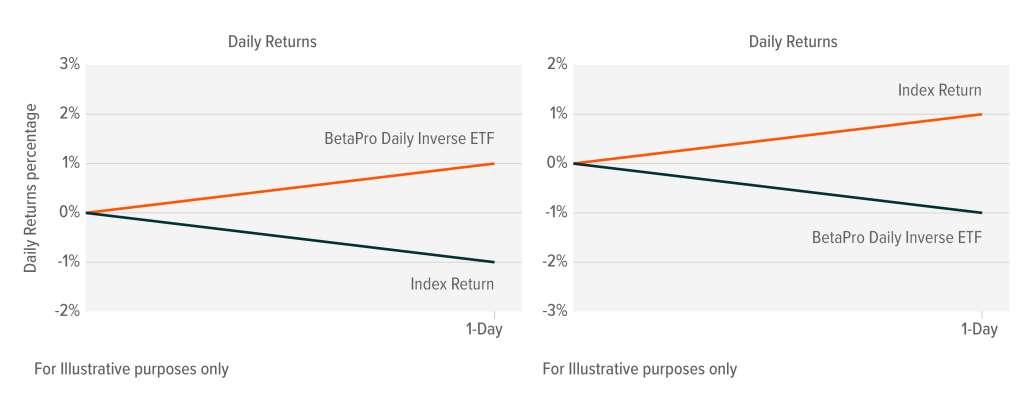

What are inverse ETFs and how do they work? Inverse ETFs aim to achieve -1x the daily performance of their respective underlying benchmark before fees and expenses.

If the underlying index of a -1x inverse ETF goes down 1% on a day, the ETF should gain approximately 1% that day. If the underlying index of the ETF goes up 1% on a day, then the ETF should decline approximately 1% that day.

DAILY REBALANCING

The BetaPro ETFs are not designed to deliver investment returns that correspond to their investment objective for periods greater than one day. One of the key benefits of using these types of ETFs is that they do not require the use of shorting or margin on the part of the investor.

In order to limit the maximum amount of risk in these ETFs to the principal investment amount – investors can lose more than their principal investment when shorting or using margin – all of the BetaPro Leveraged, Inverse Leveraged and Inverse ETFs are rebalanced daily.

The rebalancing process for each ETF takes into account the daily net purchases or subscriptions, accrued interest and expenses and the market move of the benchmark. This process is repeated each trading day.

The rebalancing process helps limit investor’s risk to the current value of their invested capital. For each BetaPro Daily Bull ETF and BetaPro Daily Bear ETF, only up to 2x or up to -2x the value of the portfolio at the end of each day is reinvested.

Effects of Compounding

Compounding is the reinvestment of earnings from an investment back into the original investment, which is then subject to the full earnings and price fluctuations of that investment, potentially resulting in a larger annual return in a rising market, or averaging your cost down in a declining market.

Through the daily rebalancing process of the BetaPro ETFs, investor’s profits will increase their investment exposure on the upside and losses will reduce their investment exposure on the downside. In other words, for periods longer than one day, the return of the ETF is not expected to match the performance of the reference commodity, benchmark or index for the same period.

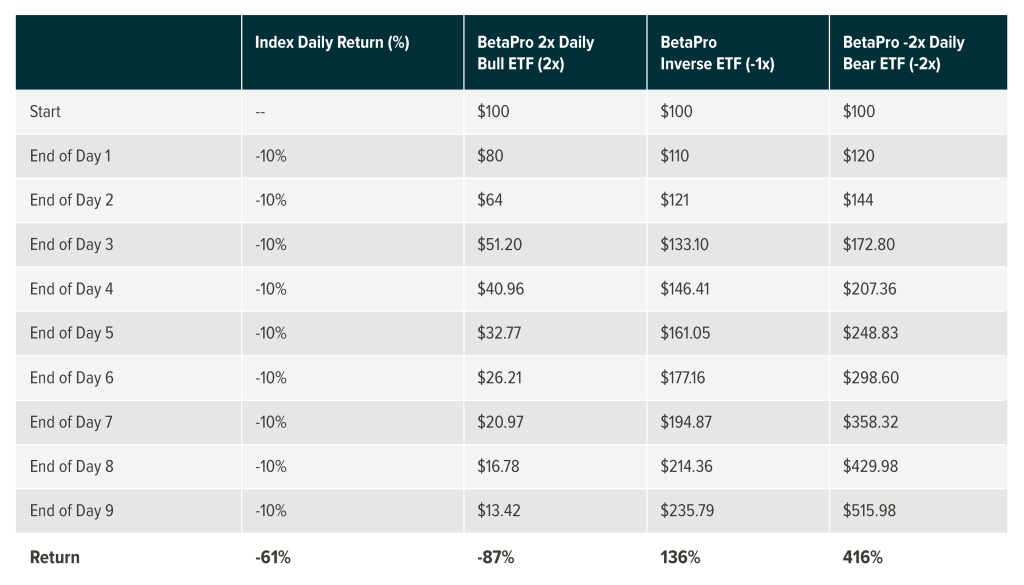

The simplified hypothetical examples below using a BetaPro Daily Bull ETF (with full 2x exposure), a BetaPro Daily Bear ETF (with full -2x exposure) and a Global X Inverse ETF (-1x) in different markets, show the potential effects of compounding as a result of daily rebalancing.

Scenario 1. An Up-Trend (5 “Up Days”)

Scenario 2. A Down-Trend (9 “Down Days”)

IMPORTANT RISK CONSIDERATIONS

The BetaPro ETFs use leverage and are riskier than funds that do not. The ETF seeks a return, before fees and expenses, of +200% or – 200% of its Referenced Index for a SINGLE DAY. The returns of the ETF over periods longer than ONE DAY will likely differ in amount, and possibly direction (of the performance, or inverse performance, as applicable) of the Referenced Index. Longer periods AND/OR greater volatility will make the possible divergence more pronounced. Investors should monitor their investment in these ETFs daily. Please read the prospectus and ensure you understand this ETF before investing in it.

These ETFs are highly speculative and use leverage, which magnifies gains and losses. These are intended for use in daily or short-term trading strategies by sophisticated investors. If you hold these types of ETFs for more than one day, your return could vary considerably from the ETF’s daily target return. Any losses may be compounded. These types of ETFs are not advisable for a longer-term investment.

DISCLAIMERS

The Global X Exchange Traded Products include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (“Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (“Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”). Included in the Leveraged and Inverse Leveraged ETFs and the Inverse ETFs are the BetaPro Marijuana Companies 2x Daily Bull ETF (“HMJU”) and BetaPro Marijuana Companies Inverse ETF (“HMJI”), which track the North American MOC Marijuana Index (NTR) and North American MOC Marijuana Index (TR), respectively. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Each Leveraged and Inverse Leveraged ETF seeks a return, before fees and expenses, that is either up to or equal to, either 200% or –200% of the performance of a specified underlying index, commodity futures index, or benchmark (the “Target”) for a single day. Each Inverse ETF seeks a return that is –100% of the performance of its Target. Due to the compounding of daily returns a Leveraged and Inverse Leveraged ETF’s or Inverse ETF’s returns over periods other than one day will likely differ in amount and, particularly in the case of the Leveraged and Inverse Leveraged ETFs, possibly direction from the performance of their respective Target(s) for the same period. For certain Leveraged and Inverse Leveraged ETFs that seek up to 200% or up to or -200% leveraged exposure, the Manager anticipates, under normal market conditions, managing the leverage ratio as close to two times (200%) as practicable however, the Manager may, at its sole discretion, change the leverage ratio based on its assessment of the current market conditions and negotiations with the respective ETF’s counterparties at that time. Hedging costs charged to BetaPro Products reduce the value of the forward price payable to that ETF. Due to the high cost of borrowing the securities of marijuana companies in particular, the hedging costs charged to HMJI are expected to be material and are expected to materially reduce the returns of HMJI to unitholders and materially impair the ability of HMJI to meet its investment objectives. Currently, the manager expects the hedging costs to be charged to HMJI and borne by unitholders will be between 10.00% and 45.00% per annum of the aggregate notional exposure of HMJI’s forward documents. The hedging costs may increase above this range. The manager publishes on its website, the updated monthly fixed hedging cost for HMJI for the upcoming month as negotiated with the counterparty to the forward documents, based on the current market conditions.

Commissions, management fees and expenses all may be associated with an investment in the BetaPro Marijuana Companies Inverse ETF (“HMJI or the “ETF”) managed by Global X Investments Canada Inc. The ETF is not guaranteed, its value changes frequently and past performance may not be repeated. The prospectus contains important detailed information about the ETF. Please read the prospectus before investing.

HMJI is very different from most other exchange-traded funds and is permitted to use strategies generally prohibited by conventional mutual funds. While such strategies will only be used in accordance with the investment objective and strategy of the ETF, during certain market conditions they may accelerate the risk that an investment in the Units of the ETF decreases in value.

HMJI, before fees and expenses, does not and should not be expected to return the inverse (e.g. -100%) of the return of its Underlying Index over any period of time other than daily.

The returns of HMJI over periods longer than one day will, under most market conditions, be in the opposite direction from the performance of its Underlying Index for the same period. However, the deviation of returns of HMJI from the inverse performance of its Underlying Index can be expected to become more pronounced as the volatility of HMJI’s Underlying Index, and/or the period of time increases.

Hedging costs charged to an ETF reduce the value of the forward price payable to that ETF. Due to the high cost of borrowing the securities of marijuana companies, the hedging costs charged to HMJI and indirectly borne by Unitholders are anticipated to be material.

Although the hedging costs of HMJI are assessed on a monthly basis to reflect the current market conditions, these hedging costs are expected to materially reduce the daily returns of HMJI to Unitholders and to materially impair the ability of HMJI to meet its investment objectives. Currently, Global X Investments Canada Inc. (the “Manager”) anticipates that, in respect of HMJI, based on existing market conditions, the hedging costs charged to HMJI and indirectly borne by Unitholders will be between 15.00% and 35.00% per annum of the aggregate notional exposure of HMJI’s Forward Documents. The hedging costs may increase beyond this range.

Although the Manager does not, as of the date of this prospectus, anticipate suspending subscriptions for new Units, it is possible that due to a Counterparty’s difficulties and costs associated with shorting the securities of constituent issuers, including the potential inability of a Counterparty to borrow securities of constituent issuers in order to “short” such issuers, HMJI will be subject to the risk that one or more Counterparties could refuse to increase the ETF’s existing notional exposure under the current Forward Documents. If the ETF cannot increase its notional exposure under the Forward Documents, the Manager will accordingly suspend new subscriptions for Units of HMJI until such time as the Manager can increase the notional exposure under the Forward Documents. During a period of suspended subscriptions, investors should note that Units of HMJI are expected to trade at a premium or substantial premium to net asset value (NAV). In such cases, investors are strongly discouraged from purchasing Units of HMJI on a stock exchange. Any suspension of subscriptions will be announced by press release and on the Manager’s website. The suspension of subscriptions, if any, will not affect the ability of existing Unitholders to sell their Units in the secondary market at a price reflective of the NAV per Unit. See “Significant Hedging Cost Risk and Risk of Suspended Subscriptions (HMJI)” in the prospectus.

Investors should read the prospectus to understand the risks and monitor their investments in the ETF at least daily.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Categories: Education, Insights

Topics: BetaPro