You might have heard that it’s “RRSP season”. What’s that? The first two months of the year – January and February – offer a unique opportunity to take control of and get a second chance to potentially better your investment or tax position from the year before.

How? By using a Registered Retirement Savings Plan (RRSP). By contributing to an RRSP, Canadians can build their savings, whether it’s for retirement, a home purchase or going back to school. Contributions in your RRSP can be invested and can grow over time – tax-free! – until retirement. You can even use your RRSP to defer or offset taxation, as contributions are tax deductible!

Doing it during RRSP season (which ends with the deadline on February 29 this year) means you can do all of that ahead of the personal tax filing deadline on April 30, 2024, and reap some of those advantages, ahead of receiving a tax return. Let’s dive into why taking advantage of RRSP season makes more than just sense and cents and later, how asset allocation ETFs can be a powerful way to invest for your future within your RRSP.

QUICK RRSP SEASON FACTS

| 18% | Canadians can contribute up to 18% of their income or up to a maximum of $30,780 for the 2023 tax year |

| It’s not just cash that can be invested in an RRSP – you have a whole range of investment options that include ETFs, stocks, bonds and mutual funds | |

| +51% | 51% of Canadians planned to contribute to their RRSP, according to an Edward Jones Canada survey |

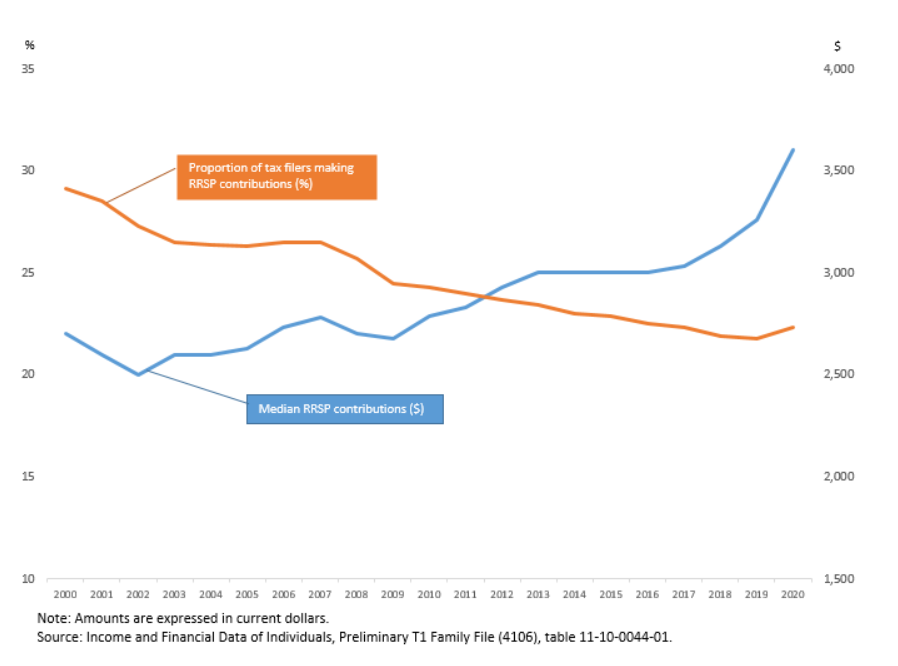

You can see how much Canadians are contributing to their RRSPs in this graph:

PROPORTION OF CONTRIBUTORS AMONG TAX FILERS AND MEDIAN REGISTERED RETIREMENT SAVINGS PLAN CONTRIBUTIONS, 2000 TO 2020

One financial consideration that’s been on a lot of Canadians’ minds is housing prices. Across Canada, home prices are up 44% over the past five years, which has resulted in a lot of concern about affordability.

RRSPs can help. Did you know that up to $35,000 from your RRSP can be unlocked before retirement to help contribute to a first-time home down payment? After taking advantage of the Home Buyers’ Plan, Canadians then have up to fifteen years to “pay it back” into their RRSP.

Another major financial challenge can be affording education. Once again, you can unlock your RRSP to go back to school with up to $10,000 through the Lifelong Learning Plan. Here’s a quick view of how an RRSP can help you achieve some of your life goals:

Here’s a quick view of how an RRSP can help you achieve some of your life goals:

WAYS AN RRSP CAN HELP WITH YOUR FINANCIAL GOALS

| Retirement is an important stage in life and the sooner you plan for and contribute to it, the better financial shape you’ll find yourself in |

| The Home Buyers’ Plan allows you to withdraw up to $35,000 from your RRSP to buy or build a home |

| Canadians looking to invest in themselves to pursue additional education can withdraw up to $10,000 each calendar year from their RRSPs under the Lifelong Learning Plan |

| The money you invest into an RRSP is tax-deductible, which reduces your tax bill and may result in a tax refund. You could use the refund to re-contribute your RRSP! |

INVESTING IN YOUR RRSP: KEY BENEFITS OF ASSET ALLOCATION

- Takes the guesswork out of investing by offering ready-made, one-click solutions

- Tailored to your level of risk to how long you’re investing

- Spread out your investment so your nest egg isn’t invested all in the same basket

Now it’s worth asking, how should you invest in your RRSP? There are a multitude of factors that should guide your decision, including: what’s your end goal? How long is your time horizon? What’s your risk tolerance?

For new investors, the number of things that should be considered can lead to an ‘analysis paralysis’ that prevents you from acting on your finances for your future.

One thing the experts typically agree on, asset allocation is one of the most important determinants in achieving your investment goals.

Think of asset allocation like this: imagine you’ve got a pot of money you want to invest. Asset allocation is just the term for spreading that money around into different types of investments. Like not putting all your eggs into one basket.

This approach can help with building a diverse portfolio and planning for the future. Simply put, you’re dividing your investment into various areas – some might be stocks, others could be bonds. By mixing it up, you can increase the chances that at least some of your investments will do well, even if others don’t. This mix helps lower the overall risk.

Different types of investments – that’s different kinds of asset classes such as equities or bonds – come with different levels of risk and potential returns. So, when you diversify your investments across different asset types, it could help you find a sweet spot that suits your investment goals – such as saving for a house or putting a little away for retirement – and how much risk you’re comfortable with. Plus, as you get older or your situation changes, you can tweak this mix to fit your evolving needs, especially as you get closer to retirement.

So how does this work? Well, you choose different types of assets with different risk levels. For example, bonds are generally considered a safer bet but might not give huge returns, while stocks can be a rollercoaster but offer the chance for bigger rewards.

What’s key is to match your choice of investments with how long you’ve got to invest, how much risk you can stomach, and what you want your retirement to look like. If you’re younger and retirement is a long way off, you can probably handle more risk. But as you get closer to retiring, it makes sense to shift to investments that are more stable and less volatile. For example, a “balanced” portfolio might include a 60% allocation to equities and a 40% allocation to fixed income while a “growth” portfolio may lean towards a 70% or above allocation to stocks.

| Stocks | Fixed Income | |

| 40% | 60% | |

| 60% | 40% | |

| 80% | 20% | |

| 100% | 0% |

Thankfully, there’s an easier option: asset allocation ETFs. These investments offer the opportunity to gain exposure to a diversified collection of securities through a single ETF. With one ETF, you get exposure to domestic, international, equity, and fixed-income investments that are tailored to your goals and risk tolerances. It’s an easy way to diversify an investment portfolio.

ETFs can also help reduce concentration risk by providing exposure to dozens or even hundreds of individual securities, making ETFs a convenient shortcut to enjoying the benefits of a diverse, balanced portfolio without the headaches of day-to-day active management.

In Canada, asset allocation ETFs hold more than $19 billion in total assets under management, with the category experiencing asset growth of 50% annually since 2018. So, there’s market demand and a use case.

GLOBAL X ASSET ALLOCATION SUITE

To help take the guesswork out of building a long-term portfolio, Global X has an Asset Allocation ETF suite that can help make investing for the future easier.

You can take a look at Global X’s Asset Allocation suite of ETF offerings here.

Global X’s Asset Allocation ETFs can help make investing for the future easy and may be the smart option for your RRSP this season. Each one of these all-in-one ETFs typically contains between five or more underlying ETFs, and pool these stocks and bonds from around the world into one simple, automatic-rebalancing investing solution. They offer a mix of exposure to equities and fixed income allowing Canadians to pick and choose the right asset mix for them.

The suite of seven asset allocation ETFs offers:

- Simple & Low Cost: Canadians can invest, the way that they want, getting diversified exposure on ETFs built with affordability in mind.

- Capital Appreciation: Over time, asset allocation ETFs have the potential to rise with the expansion of the global marketplace. Returns could go above and beyond with income from covered calls and capital returns enhanced by light leverage.

- Automatic Rebalancing: Investing made easy by putting portfolio management in the hands of our professionals.

Four of the ETFs in Global X’s Asset Allocation ETF suite employ investment strategies that could potentially magnify gains and generate additional income through option writing. GRCC and EQCL seek to generate higher yields by employing covered calls while HEQL and EQCL aim to generate approximately 1.25 times the return of their underlying portfolios by employing leverage.

With the RRSP deadline just weeks away, Canadians have a number of options available to them when it comes to putting money aside for their future. The unused contribution room also stacks from one year to the next, so people won’t miss the boat if they’re short of funds to contribute in a particular year.

Global X’s Asset Allocation ETF suite provides investors with an all-in-one approach to fund selection for those seeking opportunities to earn more sooner, so they can retire early or on time.

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Each of the units of EQCL and HEQL (the “Enhanced ETFs”) is an alternative mutual fund within the meaning of NI 81-102 and is permitted to use strategies generally prohibited by conventional mutual funds, such as the ability to invest more than 10% of the Enhanced ETF’s net asset value in securities of a single issuer, the ability to borrow cash and to employ leverage. While these strategies will only be used in accordance with the applicable investment objectives and strategies of the Enhanced ETFs, during certain market conditions they may accelerate the risk that an investment in Units of such Enhanced ETF decreases in value.

Certain statements may constitute a forward‐looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward‐looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward‐looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward‐looking statements. These forward‐looking statements are made as of the date hereof and the authors do not undertake to update any forward‐looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Published January 31, 2024

Categories: Articles, Insights

Topics: Asset Allocation, RRSP