Published May 1, 2024

Global X believes that investors should be able to access passive index strategies in the most cost and tax-efficient way possible. For this reason, each of the Global X Total Return Index ETFs (Global X TRI ETFs) provides passive exposure to an index or benchmark from within a corporate class structure. Each Global X TRI ETF is a separate corporate class, meaning its shares represent a specific class within a corporate structure. This structure allows these ETFs to seek to deliver greater tax-efficiency with less tracking error than traditional passive index or benchmark ETFs. Global X TRI ETFs primarily utilize total return swaps, and are not expected to make taxable distributions.

The Global X TRI ETFs that utilize total return swaps aim to achieve tax efficiency primarily by receiving the total return of the underlying index (before fees) – the value of the underlying index constituent distributions get reflected in the ETF’s share price and are not distributed to shareholders. This means that an investor is generally only expected to be taxed on any capital appreciation of the ETF if, and when, the shares of their ETF are sold.

HOW DOES A GLOBAL X TRI ETF WORK?

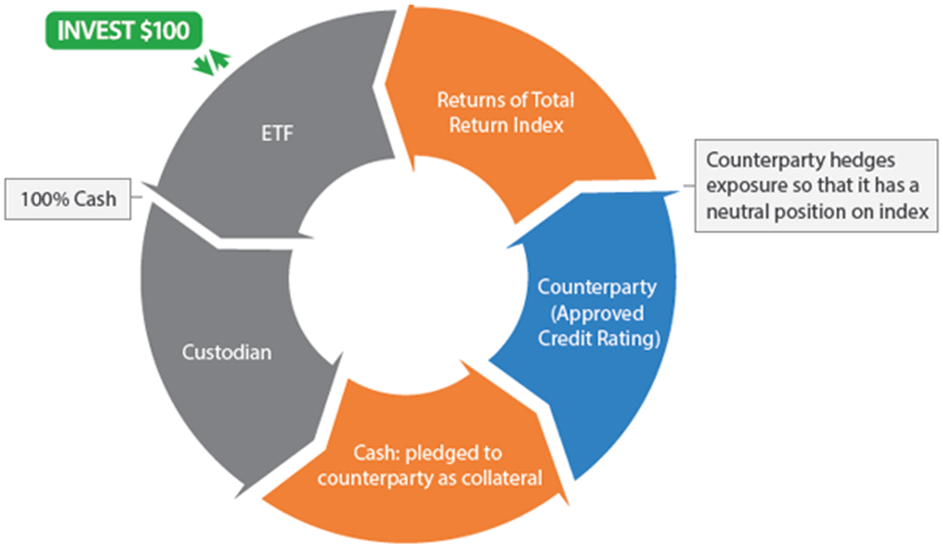

The majority of Global X TRI ETFs utilize a synthetic structure, known as a total return swap.

Unlike a traditional physical replication ETF that typically purchases the securities found in the relevant index in the same proportions as the index, most Global X TRI ETFs use a synthetic structure that never buys the securities of an index directly. Instead, the Global X TRI ETFs receive the total return of the relevant index by entering into Total Return Swap agreements with one or more counterparties, typically large Canadian financial institutions, which provide the ETFs with the total return of the relevant index. To gain exposure to certain indices through a total return swap, counterparties may charge the Global X TRI ETF a swap fee (depending on the underlying asset). The Global X TRI ETFs that provide exposure to foreign equities and fixed-income securities will typically be charged a swap fee. None of the Global X TRI ETFs that provide exposure to Canadian equities and preferred shares currently have a swap fee associated with their total return swap.

TAX-EFFICIENT INVESTING

Each of the Global X TRI ETFs is a class of shares in a corporate class structure, the Global X Canada ETF Corp. This simply means the ETFs are collectively structured as a single corporation, rather than individually as trusts, which was the traditional structure used by Canadian-listed ETFs and mutual funds.

NOTE: While the corporate class structure used by Global X TRI ETFs is generally referred to as a mutual fund corporation, that is simply how it is classified by tax authorities. All of the products offered by Global X are exchange-traded funds and not mutual funds offered via FundServ.

First established in 1987, mutual fund corporations are structured similarly to traditional corporations. Under one corporate structure, many different investment fund mandates (series or classes) can exist. In the case of Global X Canada ETF Corp., the different Global X TRI ETFs are all held within the corporate structure, where each is a separate class of shares.

Within a Canadian mutual fund corporate structure, only capital gains and Canadian dividends can be distributed to investors. From a tax perspective, any other income and foreign dividends generated within any one class of the corporation can potentially be offset by income losses and expenses incurred in other classes, which can, in certain circumstances, make the corporate class structure more tax-efficient than a traditional mutual fund trust.

It is a structure widely used by advisors in Canada and end-investors, primarily in taxable accounts, to achieve more tax-efficient returns.

WHAT MAKES THE GLOBAL X TRI ETFS CORPORATE CLASS DIFFERENT?

The major difference between the Global X TRI ETFs and other corporate class funds is that our ETFs primarily hold derivatives to achieve their investment returns, although physically replicated Index ETFs can also be held within Global X Canada ETF Corp.

Within Global X Canada ETF Corp. the Global X TRI ETFs offer distinct tax efficiencies for investors. The tax efficiency to investors can be primarily achieved through our proprietary, synthetic Total Return structure, which is used by most of the Global X TRI ETFs. There are also tax efficiencies realized by Global X Canada ETF Corp. itself, when compared to a mutual fund trust structure, since the corporation can use widely accepted corporate tax accounting options, such as the ability to use losses and expenses to offset income across all classes.

THE GLOBAL X TAX ADVANTAGE: HOW OUR CORPORATE CLASS WORKS FOR YOU

The Canadian ETF universe has a large variety of traditional, physically-replicated benchmark index products that can offer investors comparatively low-cost exposure to major indices and benchmarks. However, distributions from these investment funds generally result in taxable events for investors. These taxable distributions can reduce an investor’s potential after-tax return when compared to the potential after-tax return on investment from owning a comparable Global X TRI ETF.

PERFORMANCE COMPARISON BETWEEN A GLOBAL X TRI BOND ETF AND A TRADITIONAL INDEX BOND ETF

Global X TRI ETFs can offer a greater after-tax return on investment when held in a non-registered account, compared to a traditional, physically-replicated index ETF.

Comparison Assumption

As an illustrative example only, initial investment of $1 million, income generated to be taxed at the Ontario tax rate for investment income in a corporate structure.

In the following example we compare Global X Cdn Select Universe Bond ETF (“HBB”) (formerly Horizons Cdn Select Universe Bond ETF) to a physically-replicated bond ETF. The two leading physically-replicated bond ETFs that invest in the broad Canadian bond universe have management fees of 0.09%. Meanwhile, HBB has a management fee of 0.09% and a swap fee of approximately 0.14%, for a total fee cost of approximately 0.23% (plus applicable sales tax). It is important to note that no Horizons TRI ETFs re-characterize investment income as capital gains.

| Total Return Swap | Physical Investment | Difference (Swap – Physical) | |

| Original Investment | $1,000,000.00 | $1,000,000.00 | $0 |

| Net Distribution Income1 | $0 | $90,868.67 | $(90,868.67) |

| Compounded Pre-tax Value1 | $1,086,647.04 | $1,090,868.67 | $(4,221.63) |

| Cumulative Pre-tax Return | 8.66% | 9.09% | -0.42% |

| Annualized Pre-tax Return | 2.81% | 2.94% | -0.13% |

| Capital Gain (Loss Carried) | $86,647.04 | $0 | $86,647.04 |

| Capital Gains Tax Payable | $21,748.41 | $0 | $21,748.41 |

| Distribution Tax Payable | $0 | $45,616.07 | $(45,616.07) |

| Total Taxes Paid | $21,748.21 | $45,616.07 | $(23,867.67) |

| After-Tax Investment Amount | $1,064,898.63 | $1,045,252.60 | $19,646.03 |

| Cumulative After-Tax Return | 6.49% | 4.53% | 1.96% |

| Annualized After-Tax Return | 2.12% | 1.49% | 0.65% |

1 Returns contemplate the ETFs’ management and swap fees

FOR ILLUSTRATIVE PURPOSES ONLY

In this hypothetical example, HBB and the competitor strategy that pays out distributions, would be held for a three-year period. It makes the assumption that HBB and the hypothetical competitor would be sold at the end of this period which could incur a capital gains tax liability. Any distributions received by HBB are reflected in its net asset value and reinvested immediately upon being received, whereas the physically replicated ETF would receive distributions quarterly and then re-invest them. The comparison also makes the assumption that any distributions paid will be taxed at the marginal tax rate of the investor in the calendar year they were received. Such tax payment is funded through the redemption of units of the hypothetical competitor fund at each year end, Where a Canadian ETF holds U.S. securities, non-resident taxes will be withheld from payments that are subject to U.S. withholding taxes (such as most dividends). Depending on the ETF, some Foreign Tax Credit may be passed on to certain unitholders. No Foreign Tax Credit is contemplated in this example.

WHO SHOULD CONSIDER CORPORATE CLASS?

Investors using a Non-Registered Account – Enjoy the Benefits of Tax Deferral

Canadian investors who have already made the maximum allowable contributions to their registered investment accounts and tax-free savings accounts (TSFAs) who are seeking to invest more, will likely have to do so through a non-registered account.

Unlike registered accounts and TFSAs, non-registered accounts don’t typically provide the same taxation benefits and could require you to pay taxes on any distributions you’ve received on an annual basis. As the Global X TRI ETFs are not expected to make distributions, an investor could only be taxed on any capital appreciation if their shares of the ETF are sold.

Seniors – Preventing Income from Impacting Old Age Security

For seniors receiving Old Age Security (OAS), “clawback” on OAS payments can occur if the individual is receiving income, including dividend income, greater than $86,912 (2023).

With Global X TRI ETFs, constituent distributions are instead reflected as part of the ETF’s total return. This means that seniors seeking to ensure their OAS payments aren’t impacted by the income they receive from their investments can alternatively consider using our Global X TRI ETFs.

In-trust Accounts – Ensure Your Nest Egg Stays Strong for Generations

For those investing for minor dependents or relatives through an in-trust account, it’s important to know that in-trust investments are typically subject to income attribution, meaning the onus to pay taxes on the income the trust generates will be on the contributor to the trust rather than the beneficiary of the trust. However, this doesn’t apply to capital gains. As the Global X TRI ETFs are not expected to make distributions, an investor is generally only expected to be taxed on any capital appreciation if their shares of the ETF are sold.

Small Business Owners – Tax-Efficiency for Corporate Accounts

If you’re a small business owner looking to invest with your corporate account, it’s important to know that passive investment income can reduce your Small Business Deduction (SBD) tax credit, at a rate of $5 for every $1 of investment income above the $50,000 threshold. Global X TRI ETFs offer small business owners a way to potentially grow their corporate account portfolios without negatively affecting their SBD tax credit.

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The Global X money market funds are not covered by the Canada Deposit Insurance Corporation, the Federal Deposit Insurance Corporation, or any other government deposit insurer. There can be no assurances that the money market fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the Funds will be returned to you. Past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Categories: Education, Insights

Topics: Fixed Income