Following Monday’s federal election, Canadians welcomed a fourth consecutive Liberal government led by Prime Minister Mark Carney.

In the days following, the market’s initial reaction has been notably calm, with slight positivity in Canadian equities while the loonie fell slightly against the U.S. dollar, indicating a cautious yet stable response to the continuation of Liberal leadership.

Chris McHaney, Executive Vice President of Investment Management and Strategy at Global X, sat down with Ticker Take’s Jon Erlichman to share his insights on how the markets are interpreting this political outcome and the economic implications moving forward.

What’s Behind the Market Reaction to the Election Results?

McHaney highlights several factors behind the market’s tempered reaction:

- Status Quo Stability: The incumbent party retaining power brings familiarity and continuity. The result was also in line with polls, suggesting markets had already “priced in” Carney as Prime Minister.

- Minority Government Uncertainty: Questions remain regarding the Liberals’ ability to pass promised policies, leading markets to adopt a cautious “wait and see” approach.

- U.S. Trade Policy Dominance: Canadian market sentiment remains heavily influenced by U.S. trade relations, overshadowing domestic political developments.

What are the Economic Issues Influencing Voters?

Global X’s McHaney feels that two major sentiments among Canadians shaped investment decisions in this election:

- U.S.-Canada Relations and Trade Policies: Dominated voter focus, particularly concerns around economic sovereignty and manufacturing job security.

- Shift from Regional to National Interests: Evidenced by declining support for regional parties and increased backing for major national parties.

What Sectors Could Benefit from the Election Result?

The election outcome, coupled with Liberal promises and Mark Carney’s economic strategy, signals potential benefits for several sectors, including:

- Renewable Energy & Electrification: Anticipated investment in renewable energy, electric grid infrastructure, battery technology, and related industries.

- Infrastructure & Housing: Commitments to housing construction imply increased demand for commodities such as timber and metals.

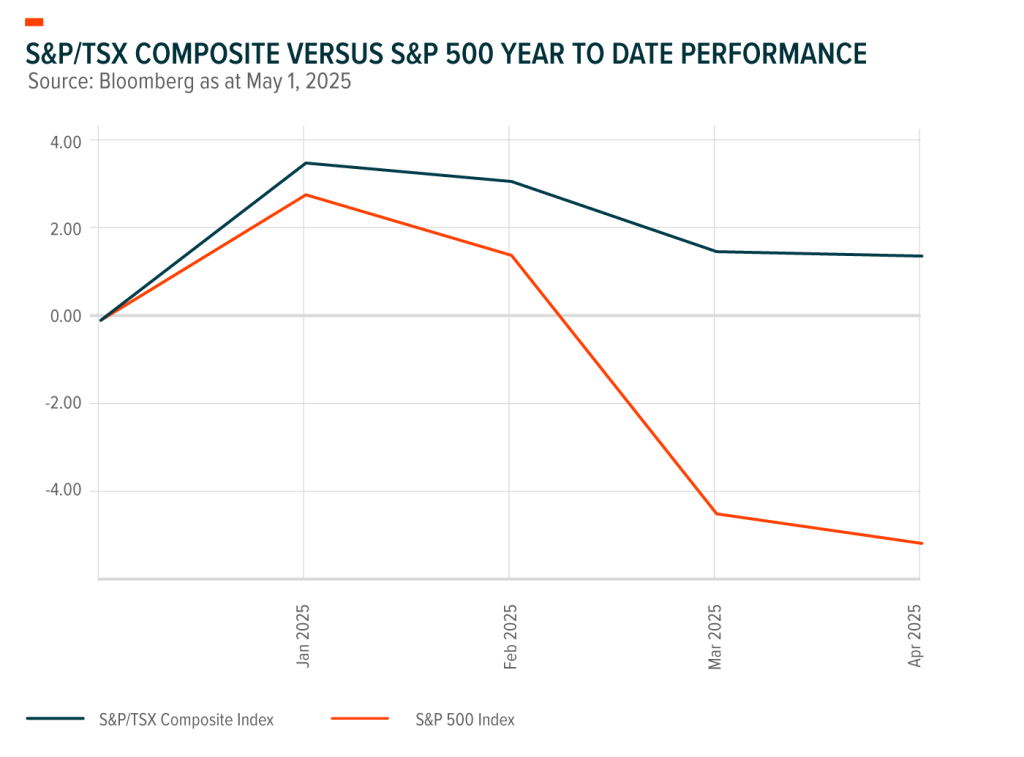

How Does Canadian vs. U.S. Market Performance Stack Up?

Interestingly, despite economic uncertainty, the Canadian stock market has outperformed the U.S. market year-to-date. McHaney attributes this to:

- Technology Sector Weakness in the U.S.: Canada’s relative insulation due to less exposure to tech-heavy growth sectors.

- Commodities and Industrial Strength: Stronger performance from Canada’s resource-rich industrial base.

What are Some Key Economic Indicators to Watch?

| Canadian Data Snapshot | |

|---|---|

| March Unemployment Rate | 6.7% |

| March Inflation Rate | 2.3% |

| February Real Gross Domestic Product Rate | -2.3% |

Investors should closely monitor:

- Labour Market Trends: Manufacturing sector layoffs or factory closures could indicate broader economic challenges.

- GDP Growth Rates: Signs of economic acceleration or deceleration will inform future market expectations.

What’s the Interest Rate Outlook?

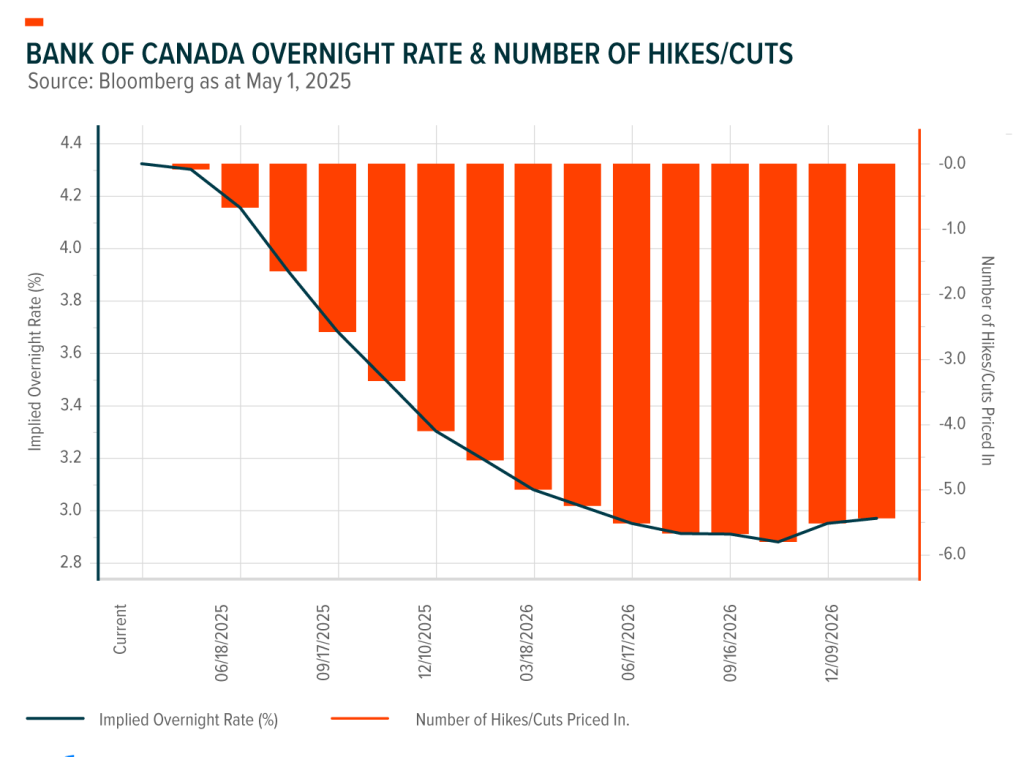

Market consensus anticipates potential further rate cuts by the Bank of Canada to stimulate economic activity amidst ongoing trade tensions.

However, McHaney believes that the promised fiscal stimulus through Liberal spending plans could partially offset the need for aggressive monetary easing, potentially limiting further immediate cuts.

Long-term, he sees increased government borrowing and deficit spending possibly leading to moderately higher long-term interest rates.

What are Some Opportunities for Future Growth for Canada?

To sustainably boost economic growth, McHaney emphasizes targeted policy initiatives:

- Incentivizing Domestic Investment: Policies such as increased TFSA limits or reduced GST on significant purchases (housing, autos) could stimulate domestic reinvestment.

- Prudent Policy Implementation: Carefully executed incentives could significantly contribute to long-term economic stability and growth.

Understanding the post-election economic landscape helps investors and policymakers navigate the challenges and opportunities ahead. As Chris McHaney suggests, thoughtful policy implementation and strategic sector investments will be crucial to Canada’s economic resilience.

DISCLAIMERS

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

The views/opinions expressed herein are solely those of the author(s) and may not necessarily be the views of Global X Investments Canada Inc. All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published May 2, 2025