Key Takeaways

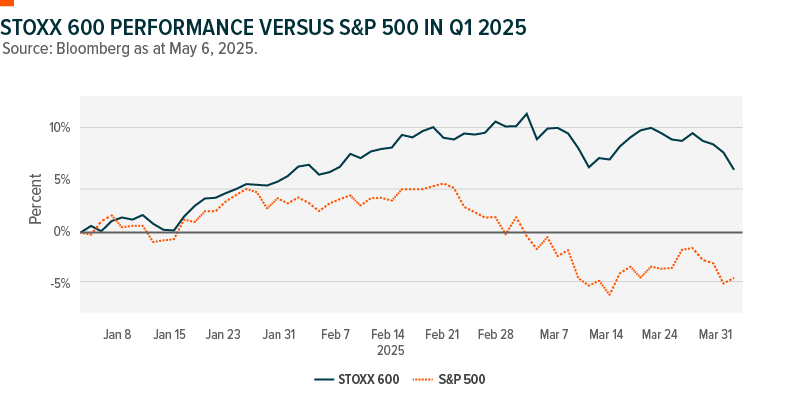

- Europe Regains Investor Attention: European markets are showing fresh momentum amid fiscal expansion and geopolitical shifts. Amid growing investor interest, Europe is re-emerging as a competitive alternative to U.S. equities with the STOXX Europe 600 up nearly 7% in the first quarter, driven by sector strength in defence and financials versus the S&P 500, which was down almost 0.5%1 .

- Attractive Valuations and Policy Tailwinds: European equities remain discounted on a forward valuation basis relative to U.S. peers. Combined with fiscal support, infrastructure investment, and rising defence budgets, this creates a supportive backdrop for long-term growth.

- Diversification in a Shifting Global Landscape: As U.S. uncertainty rises, investors are rebalancing toward international exposure. Europe’s resilience, lower inflation risks, and evolving leadership may offer meaningful diversification through targeted regional ETFs.

Rising geopolitical uncertainty and the threat of tariffs are prompting investors to reassess their global allocations—and increasingly, that means reducing exposure to U.S. markets. The first quarter of the year unfolded against a backdrop of shifting diplomacy, political transitions in key economies, and efforts to resolve ongoing conflicts.

Despite this, Europe was off to a strong start. As of the first quarter, Europe’s major stock index delivered a positive performance. In contrast, the main U.S. index lagged.

After years of underperformance, European financial markets are showing renewed strength, driven in part by shifting global trade dynamics and evolving geopolitical leadership. As the U.S. rethinks its long-standing role in global security and commerce, investors are increasingly turning their attention to opportunities across the Atlantic.

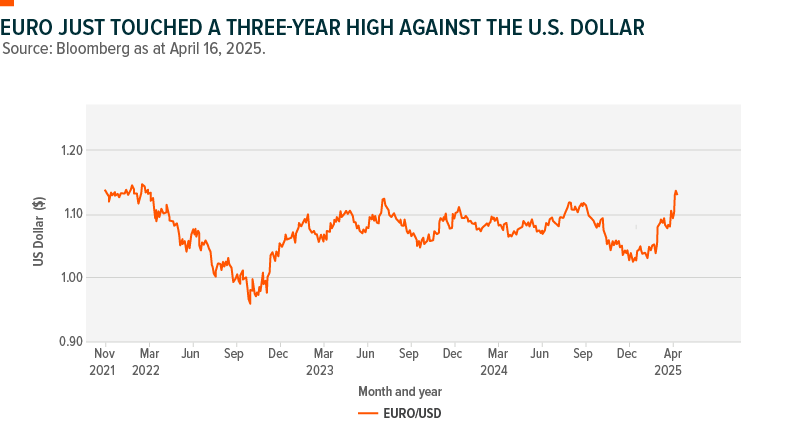

Additionally, the euro reached its highest level in recent years, while German government bonds have outperformed U.S. Treasuries. Despite headwinds from ongoing trade disputes, European equities have demonstrated notable resilience, outpacing their U.S. counterparts.

An Investment Case for Europe

This reawakening of Europe’s capital markets could mark a structural shift, offering potential for investors looking to diversify geographically and position portfolios for a new era of global realignment.

“The deviation in valuations between US and European markets has grown in recent years, but there’s potential for that gap to come in as investors begin to question the theme of U.S. exceptionalism, and we’re already seeing some of that occur,” says Alex Smahtin, Portfolio Manager and Senior Analyst, Investment Management at Global X.

These are some structural factors prompting renewed investor interest in European equities:

- Fiscal policy in Europe is shifting toward greater spending, supporting domestic growth across the region.

- Questions are emerging around the long-term return potential of U.S. mega-cap tech stocks, which have dominated global performance in recent years.

- Rising tariff risks could weigh more heavily on the U.S. than Europe. U.S. protectionist measures could stoke inflation and add to economic uncertainty—two headwinds for growth and consumer confidence. Europe, meanwhile, might feel less inflationary pressure from trade disruptions.

The price-to-earnings ratio is a commonly used measure of a company’s valuation, which is used to help investors determine if a particular stock is over- or undervalued. As seen in the chart below, valuations remain compelling. European equities continue to trade at a discount relative to their U.S. peers, potentially offering investors attractive entry points in a shifting global landscape at a time when Europe appears poised to reawaken economically.

Germany: Investment Über Alles

Germany boasts the largest economy in the Eurozone and the third largest among individual countries globally.2 Its economy is also diverse with the nation’s industrial, manufacturing, financial, and technology sectors supporting exports as well as domestic consumption growth.

The nation’s new coalition government is planning to put hundreds of millions of euros into stimulating the economy and improving the nation’s infrastructure. The new government is expected to take action on key policies, which could lead to structural energy and fiscal reforms. Germany has also agreed to expand its defence and infrastructure spending to as much as US$547 billion.

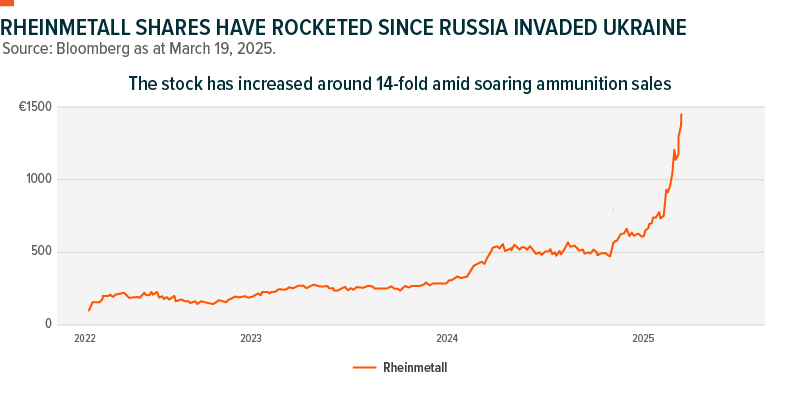

One beneficiary of Germany’s anticipated spending is defence company Rheinmetall, which signed its largest-ever framework contract with the German Armed Forces for the digitization of infantry soldier systems. The agreement, valued at up to EUR 3.1 billion (US$3.2 billion), will run until the end of 2030.

The company’s stock has also displayed remarkable performance in recent years:

“The Best Defence”

European Union (EU) nations spent EUR326 billion on defence in 2024, driven by prolonged conflicts in Ukraine and the Middle East, as well as a global push to modernize aging military equipment.

World military spending reached US$2.7 trillion in 2024, an increase of 9.4% in real terms from the prior year and the steepest year-on-year rise since at least the end of the Cold War. Around 55% of global military spending was carried out by members of NATO with Germany and the United States amongst the world’s top five military spenders, according to the Stockholm International Peace Research Institute.

| 2024 World Military Spending | US$2.7 Trillion |

| Share of Military Spending by NATO | 55% |

| Increase in European Military Spending | +17% |

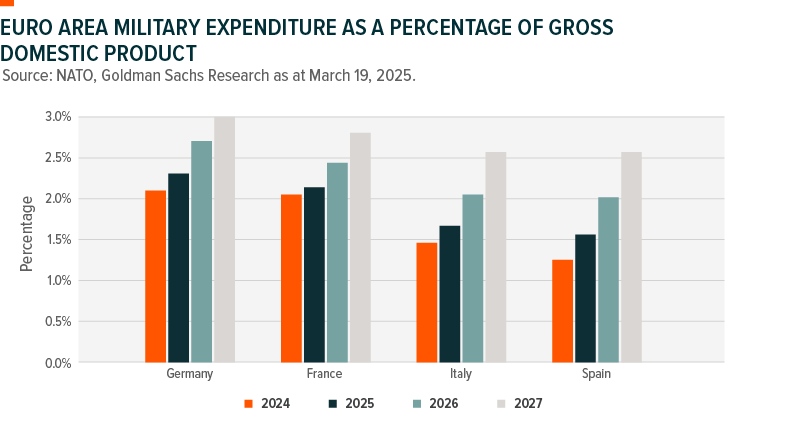

According to research from Goldman Sachs, leading European nations will be increasing their defence spending in the coming years.

How to Invest

A surge in global defence spending is expected to benefit companies offering advanced systems such as artificial intelligence, cybersecurity, and autonomous weapons. The Global X Defence Tech Index ETF (SHLD) is the first ETF in Canada providing access to global defence companies involved in the development and manufacture of military hardware and software.

As investors look away from volatile U.S. markets, European markets, with their better valuations, could be a new destination.

Global X also offers access to Europe through its Equity Essentials suite of ETFs, some of which invest in the MSCI EAFE Index (EAFE is short for “Europe, Australasia, and the Far East”).

“Broad EAFE ETFs are a natural ‘one-stop-shop’ solution for investors looking to diversify their geographic exposure without necessarily needing to bet on a given country,” Global X’s Smahtin adds.

“This is particularly prudent given the remaining uncertainty around tariffs and how individual countries will be impacted in coming months and years.”

This MSCI index covers 21 developed markets around the world, with 46% of the index’s 766 constituents based in Europe as at April 30, 2025. For investors looking to capitalize on Europe’s relative value and improving outlook, Global X’s regionally focused ETFs offer diversified access to leading European companies.

European markets are gaining traction as fiscal stimulus, defence spending, and policy shifts support growth. With valuations still attractive and geopolitical risks weighing on U.S. assets, investors are reconsidering their global allocations. Europe’s renewed resilience may offer diversification benefits and long-term opportunity through targeted exposure to regional equity strategies.

Related ETFs

SHLD – Global X Defence Tech Index ETF

EAFX/EAFX.U – Global X MSCI EAFE Index ETF

EAFL – Global X Enhanced MSCI EAFE Index ETF

EACC – Global X MSCI EAFE Covered Call ETF

EACL – Global X Enhanced MSCI EAFE Covered Call ETF

SOURCES

1 Source: Bloomberg as at May 6, 2025.

2 Source: Statista as at February 12, 2025, The 20 Countries With the Largest Gross Domestic Product (GDP) in 2024.

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Certain ETFs are alternative investment funds (“Alternative ETFs”) within the meaning of the National Instrument 81-102 Investment Funds (“NI 81-102”) and are permitted to use strategies generally prohibited by conventional mutual funds, such as the ability to invest more than 10% of their net asset value in securities of a single issuer, the ability to borrow cash, to short sell beyond the limits prescribed for conventional mutual funds and to employ leverage of up to 300% of net asset value. While these strategies will only be used in accordance with the investment objectives and strategies of the Alternative ETFs, during certain market conditions they may accelerate the risk that an investment in ETF Shares of such Alternative ETF decreases in value. The Alternative ETFs will comply with all requirements of NI 81-102, as such requirements may be modified by exemptive relief obtained on behalf of the ETF.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship MSCI has with Global X Investments Canada Inc. (“Global X”) and any related funds.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

Published May 16, 2025.