Amidst trade wars, geopolitical risks, and dovish central banks at the forefront of investors’ minds, Global X explores why investors may want to consider gold and silver in the context of the current environment.

Key Takeaways

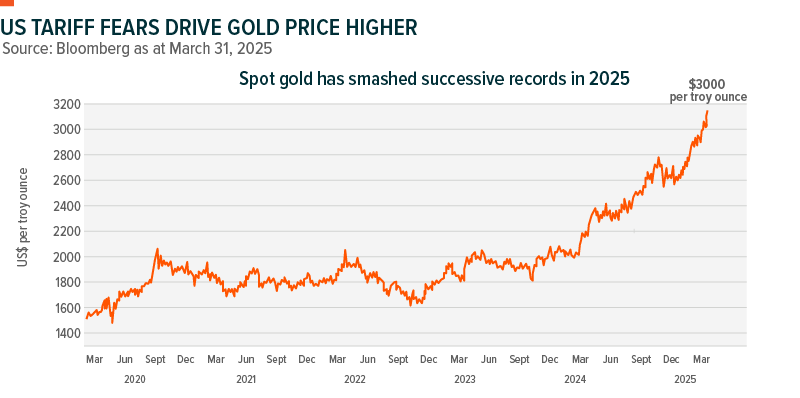

- Gold’s Safe-Haven Appeal: Amid renewed geopolitical risk and shifting U.S. policy, gold has rallied to record highs in 20251. Investor demand is surging, driven by its traditional role as a store of value and supported by tariff concerns and arbitrage opportunities in the futures market.

- Silver’s Dual Demand Drivers: Silver offers both precious metal stability and industrial growth potential. With robust industrial demand—especially from green technologies—and a historically high gold-to-silver ratio, silver may be undervalued and positioned for further upside.

- Diverse Access Points for Investors: Exposure to precious metals can be achieved through physical bullion, futures, mining stocks, or ETFs. Each approach carries different benefits and risks, with ETFs offering liquidity, diversification, and cost efficiency.

Gold

Gold has historically served as a store of value during market turbulence. Its physical nature can offer a sense of stability when risk sentiment turns.

That safe haven role is in focus again in early 2025, as investors respond to renewed geopolitical tensions and shifting U.S. policy under President Donald Trump. Gold has hit fresh record highs, extending strong gains from last year.

While not yet directly targeted by tariffs, precious metals could be caught in broader trade actions1. That risk has spurred a transatlantic shift in holdings, with more gold moving from London to New York as investors seek stability.

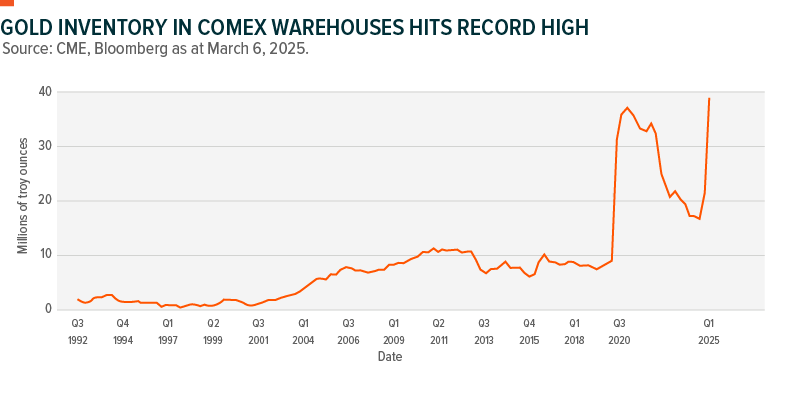

Concern over U.S. import tariffs have driven Comex gold futures prices above spot prices, creating a lucrative arbitrage opportunity, resulting in gold bullion inventories reaching record highs:

To take advantage of the high premium gold futures have been experiencing, financial institutions have been flying gold from Asia and the Middle East to North America. Traditionally, gold bullion is transported eastwards from the West to meet demand in China and India, the world’s two largest consumers.

“It is possible that we could see the transatlantic shipments slow once the U.S. tariff issue is resolved, but several other factors are driving the price of gold higher, including a declining U.S. dollar and declining interest rates,” says Global X Research Analyst Brooke Thackray.

One major bank predicts that gold’s rally may have further to run: Goldman Sachs has updated its year-end gold price forecast to $3,300 an ounce.

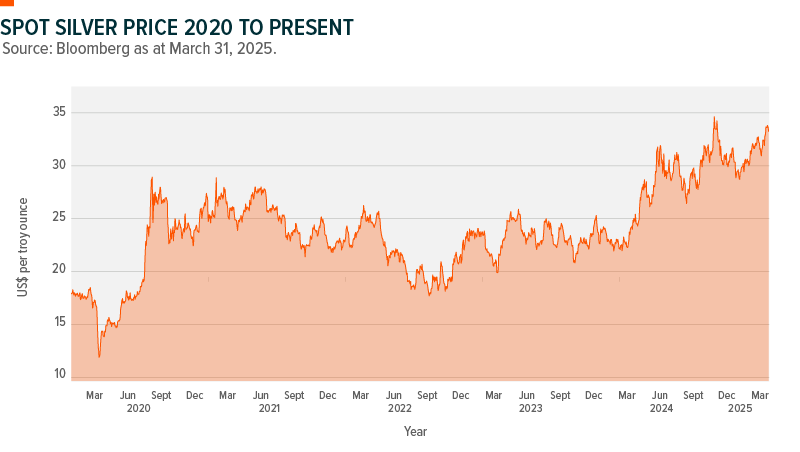

Silver

While both gold and silver are classified as precious metals, silver stands out for its industrial utility — which accounts for roughly 58%3 of annual demand. In contrast, only about 11% of gold demand is industrial, with the rest tied to jewelry, bullion, and central banks.

As a result, silver prices are influenced by both safe-haven demand and trends in industrial activity, giving it a more diversified demand profile than gold.

Ongoing geopolitical and macroeconomic risks have supported demand for safe-haven assets. A spike in silver prices was further driven by short covering in the futures market amid concerns over President Trump’s tariff agenda.

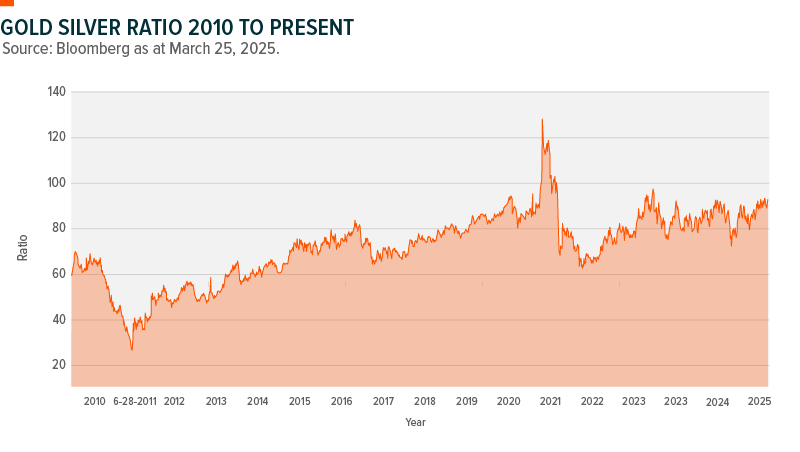

Another valuation used by investors and traders to assess the relative value of the two precious metals and help guide buy or sell decisions is the gold-to-silver ratio, which measures the number of ounces of silver that equals the price of one ounce of gold.

Historically, the ratio has averaged approximately 65 over the last 30 years.4 With the ratio currently near 90, it may signal that silver is undervalued relative to gold.

“There is a positive correlation between the price of gold and silver, as both are classified as precious metals. Silver is often referred to as the poor man’s gold,” Global X’s Thackray adds.

“The gold to silver ratio can only be stretched so far, before investors take an increasing interest in silver.”

The silver market is forecast to record another significant deficit, according to data from the industry body The Silver Institute:

- Silver demand is expected to remain stable in 2025 at 1.20 billion ounces.

- Silver supply is seen reaching an 11-year high of 1.05 billion ounces in 2025.

- Silver physical investment forecast to rise by 3%.

The Silver Institute says that silver industrial demand will remain the key driver of the supply/demand backdrop, with volumes projected to hit a new record high this year.

The silver industry body sees increased industrial usage gains coming from “Green Economy” applications (such as solar panels) and consumer electronics.

How To Invest

Investors have several options for gaining exposure to gold and silver — from buying physical bullion to trading futures.

Another approach is through mining stocks or ETFs, which are generally more liquid and can offer leveraged exposure to precious metals prices. Miners may benefit from rising prices by expanding production and increasing margins, unlike physical holdings.

Mining stocks can also add diversification to portfolios, particularly in times of geopolitical uncertainty. ETFs may help mitigate single-stock risk by holding a broad basket of miners or even direct exposure to the metals themselves — all under one management fee.

In a climate of trade tensions and geopolitical uncertainty, gold and silver remain relevant portfolio tools. Gold offers a traditional hedge in volatile markets, while silver’s mix of industrial and precious metal demand adds diversification. With silver trading at a discount to gold and supply lagging demand in 2025, investor interest may continue to grow.

Whether through bullion, futures, or ETFs, investors have flexible options to gain exposure and position for resilience in a shifting global environment.

Related ETFs

HUG – Global X Gold ETF

HUZ – Global X Silver ETF

HGY – Global X Gold Yield ETF

GLDX – Global X Gold Producers Index ETF

GLCC – Global X Gold Producer Equity Covered Call ETF

GLCL – Global X Enhanced Gold Producer Equity Covered Call ETF

SOURCES

1 Source: Bloomberg News (February 27, 2025), What’s Driving the Gold Rush From London to New York?

2 Source: Bloomberg News (March 14, 2025), Gold Breaks Through $3,000 as Trump Turbocharges Record Rally

3 Industrial demand is calculated as a percentage of total demand from the Silver Institute’s World Silver Survey 2024.

4 Source: Global X ETFs US (June 9, 2022), Silver, Explained

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Certain ETFs are alternative investment funds (“Alternative ETFs”) within the meaning of the National Instrument 81-102 Investment Funds (“NI 81-102”) and are permitted to use strategies generally prohibited by conventional mutual funds, such as the ability to invest more than 10% of their net asset value in securities of a single issuer, the ability to borrow cash, to short sell beyond the limits prescribed for conventional mutual funds and to employ leverage of up to 300% of net asset value. While these strategies will only be used in accordance with the investment objectives and strategies of the Alternative ETFs, during certain market conditions they may accelerate the risk that an investment in ETF Shares of such Alternative ETF decreases in value. The Alternative ETFs will comply with all requirements of NI 81-102, as such requirements may be modified by exemptive relief obtained on behalf of the ETF.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

© 2025 Global X Investments Canada Inc. All Rights Reserved.

For more information on Global X Investments Canada Inc. and its suite of ETFs, visit www.GlobalX.ca

Published April 3, 2025.