Amid the high-interest rate environment, many investors have been turning their attention to U.S. government bonds as a way to generate attractive levels of income in a safer and more stable manner relative to other income-producing investments.

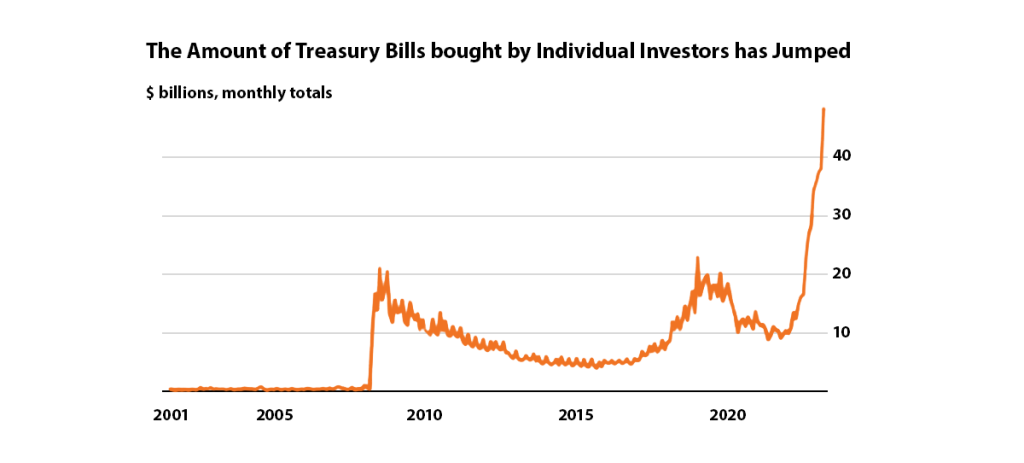

Since 2021, household holdings of U.S. government treasuries have increased by US$1.7 trillion, according to October 2023 data from the U.S. Department of the Treasury, which also says that the demand base has shifted “toward more price sensitive investors” and that over the medium-term, demand from investment funds is also likely to increase. According to a 2023 survey, 31% of U.S. retail investors last year were interested in short-term U.S. Treasury bills as part of their overall investment portfolio strategy.

WHAT ARE THEY?

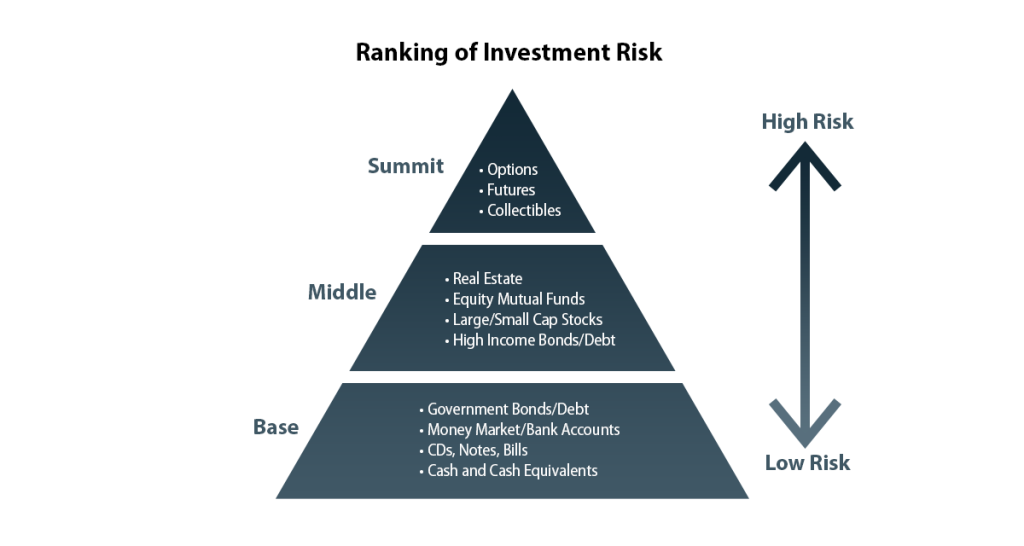

The U.S. Treasury issues different types of debt instruments to investors, some of which pay a fixed interest rate over a specific period. Overall, these securities are considered one of the safest investment options available, as they are backed by the full faith and credit of the U.S. government itself.

These debt instruments play an important role in the global financial system, offering a safe haven for investors during turbulent times.

U.S. Treasury Bills (“T-Bills”) are short-term debt instruments with maturities of one year or less.

U.S. Treasury Notes have maturities ranging from two to ten years while U.S. Treasury Bonds have the longest maturity of all: ranging from 20 to 30 years.

WHY DO PEOPLE INVEST IN THEM?

U.S. government debt instruments can be found in a well-diversified fixed-income portfolio that is designed to balance out the volatility that can come from holding just equities alone.

There are a few reasons for that.

Firstly, they can result in an attractive level of income, relative to their low level of risk. Treasury notes and bonds generate income in the form of interest and coupon payments (think of them almost like a guaranteed dividend from holding U.S. government debt securities).

Secondly, as highlighted before, U.S. T-Bills are considered amongst the safest assets you can own, even more so than Treasury Bonds and Notes. Why? While the U.S. Government’s ability to pay back its bond debts hasn’t been a concern for most investors, shorter maturity means that you’re receiving your principal back sooner than longer maturity U.S. debt instruments.

With solid yields and potential for price appreciation, U.S. government debt instruments can offer a prudent hedge and income generator for investors’ portfolios.

Relative to higher-risk securities, like stocks, Treasury bonds will have a lower expected total return. Yet even during periods of low yields, U.S. Treasury bonds remain sought-after because of their perceived stability and liquidity.

A KEY BENCHMARK & INDICATOR OF RATES

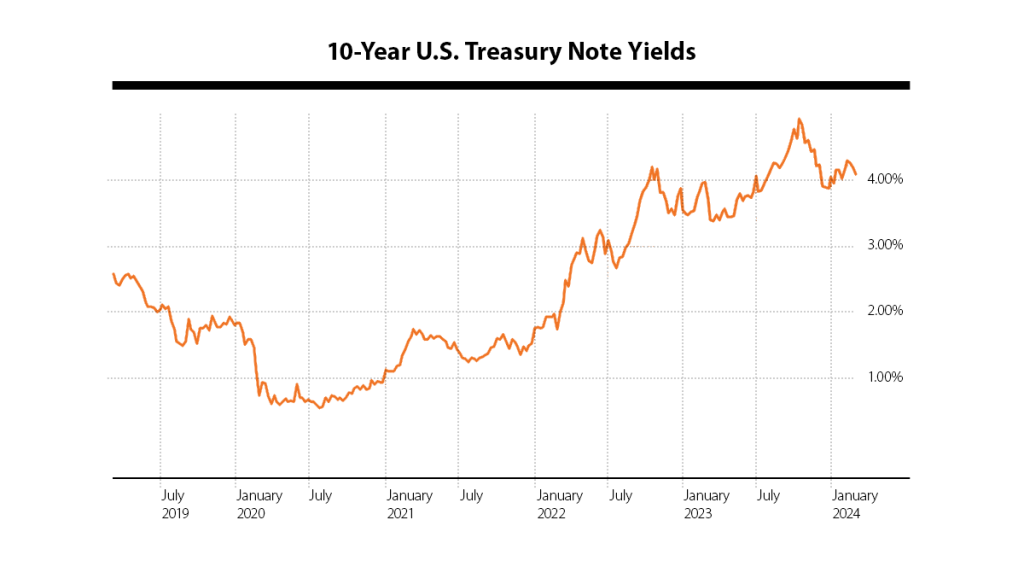

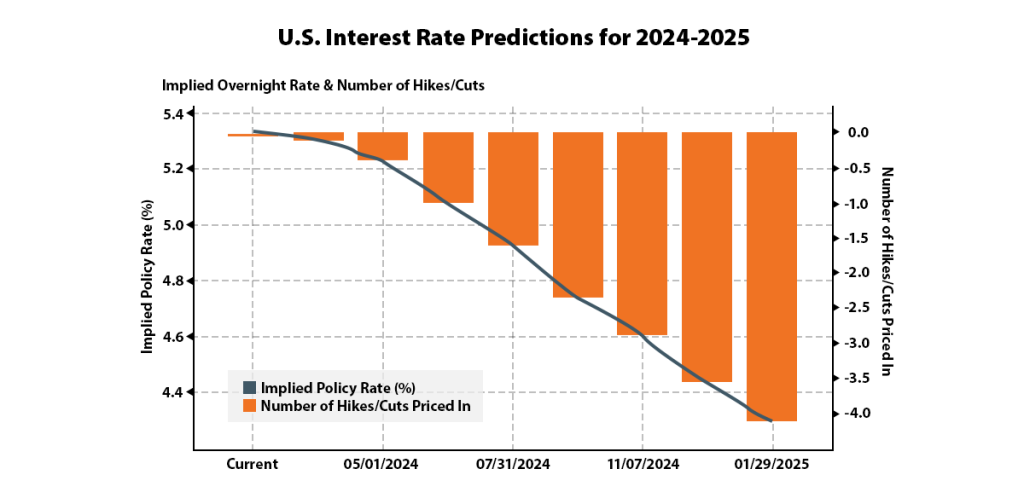

The 10-year Treasury bond is used as a measure of investor sentiment on the U.S. economy. It acts as a benchmark and proxy for long-term interest rates, affecting other bonds, mortgages, loans and savings rates. Later this year, the Federal Open Market Committee (FOMC) – which sets rates for the U.S. Federal Reserve – is widely expected to start cutting rates along with a moderated approach to quantitative tightening.

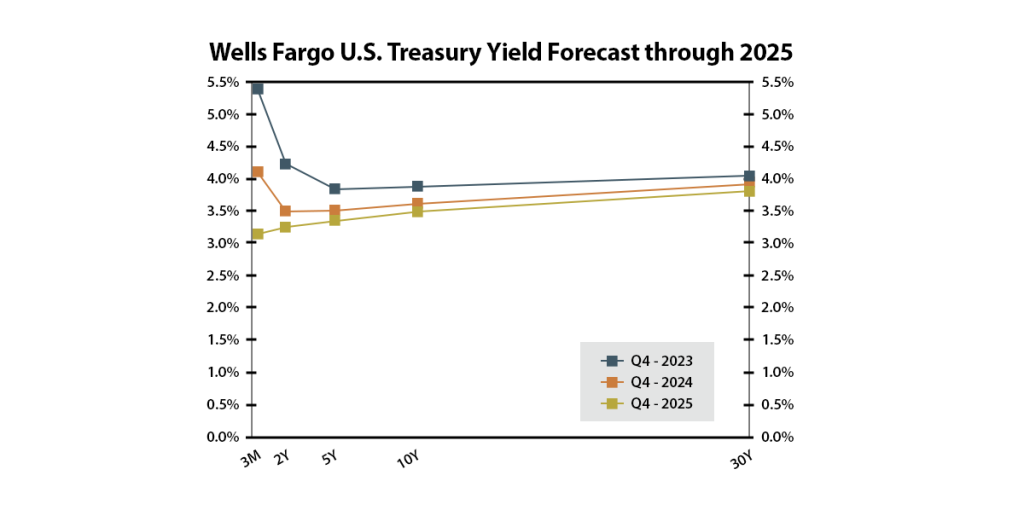

Economists at U.S. bank Wells Fargo are forecasting that the yield on 10-year Treasury bonds will be at 3.60% by the end of the year, exceeding the 2.27% average recorded between 2015 and 2019, indicating a sustained deviation from historical norms.

INVESTING IN U.S. TREASURIES: THE HORIZONS ETFS’ PREMIUM YIELD ETFS

Horizons ETFs was the first Canadian exchange-traded fund (ETF) provider to launch 0-3 month U.S. Treasury Bills (T-bills) last year. The company launched its first U.S. treasury bond ETF in 2015. It also launched the first 0-3-month Canadian T-Bill ETFs last year as well.

Treasury bond ETFs can provide investors with a convenient and easy way to invest in this asset class and generate fixed income. Within a diversified portfolio, Treasury bonds can help minimize risk while earning a stream of income. Unlike mutual funds, ETFs are easy to trade and do not have the lock-in periods involved in products, such as Guaranteed Investment Certificates (GICs). Horizons ETFs offers the Premium Yield ETFs series which is comprised of three U.S. ETFs that allow you to choose the duration you want: the Horizons Short-Term U.S. Treasury Premium Yield ETF (SPAY), the Horizons Mid-Term U.S. Treasury Premium Yield ETF (MPAY), and the Horizons Long-Term U.S. Treasury Premium Yield ETF (LPAY). Each fund also has a U.S. dollar-denominated equivalent (SPAY.U, MPAY.U and LPAY.U).

These three ETFs are designed to help investors maximize their monthly income potential above what is typically offered by Treasury bonds combined with the strength and security of U.S. government bonds.

SPAY targets a duration of under three years, MPAY generally targets a duration of between five and 10 years while LPAY generally targets a duration of over 10 years.

Duration is used to measure the potential impact that credit risk and interest rate risk have on a bond’s price because both of these factors affect a bond’s expected yield to maturity – that’s the total return if a bond is held until maturity.

In addition to offering U.S. government debt exposure, the Premium Yield ETF Suite employs an options-writing overlay to provide yield and distributions. The options-writing portion of the Premium Yield ETF Suite provides flexibility to capitalize on changing market conditions while maintaining a sustainable and tax-efficient distribution suitable to a vast range of fixed-income investors and environments.

In summary, the Premium Yield ETF Suite aims to:

- Give exposure to the strength and security of U.S. Treasuries

- Mitigate credit risk

- Generate monthly income from an active options-writing strategy

You can find out more about the Premium Yield ETF Suite here.

DISCLAIMERS

Certain statements may constitute a forward‐looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward‐looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward‐looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward‐looking statements. These forward‐looking statements are made as of the date hereof and the authors do not undertake to update any forward‐looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase exchange traded products (the “Horizons Exchange Traded Products”) managed by Horizons ETFs Management (Canada) Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor. All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Published March 15, 2024

Categories: Articles, Insights

Topics: Bonds, Fixed Income, Treasury