Published May 1, 2024

There are many ways for Canadian investors to gain exposure to Canadian and U.S. dollar exchange rate movements such as investing in domestic and foreign securities, as well as buying property on either side of the border. However, the vast majority of these transactions require an expensive currency conversion, where a bank or foreign exchange company will likely charge a significant commission as a part of the transaction. Typically, on currency exchanges of less than $10,000 dollars, non-institutional rates apply, which are less favourable.

DLR: BETTER TOOLS FOR CAPTURING CURRENCY MOVEMENTS

Global X created the Global X US Dollar Currency ETF (“DLR”) (formerly Horizons US Dollar Currency ETF) to make investing in currency movements simpler and more economical.

DLR can be used as a tool to be “long” or “bullish” on the U.S. dollar without undergoing an expensive conversion process; or if U.S. dollars are required, it can be used as an easy and efficient way to avoid the high commissions charged on converting the loonie to the greenback.

The Global X US Dollar Currency ETF

DLR, listed on the TSX, seeks to reflect the price, in Canadian dollars, of the U.S. dollar, net of expenses, by investing primarily in U.S. cash and cash equivalents. The U.S.-dollar-denominated version of this ETF, (“DLR.U”) has the same investment objective but is priced and transacted in U.S. dollars and reflects the current exchange rate. When the U.S. dollar appreciates relative to the Canadian dollar (i.e. the U.S. dollar/Canadian dollar exchange rate increases), the value of DLR is expected to increase proportionately. Conversely, when the U.S. dollar depreciates against the Canadian dollar (i.e. the U.S. dollar/Canadian dollar exchange rate decreases), the value of DLR is expected to decrease proportionately.

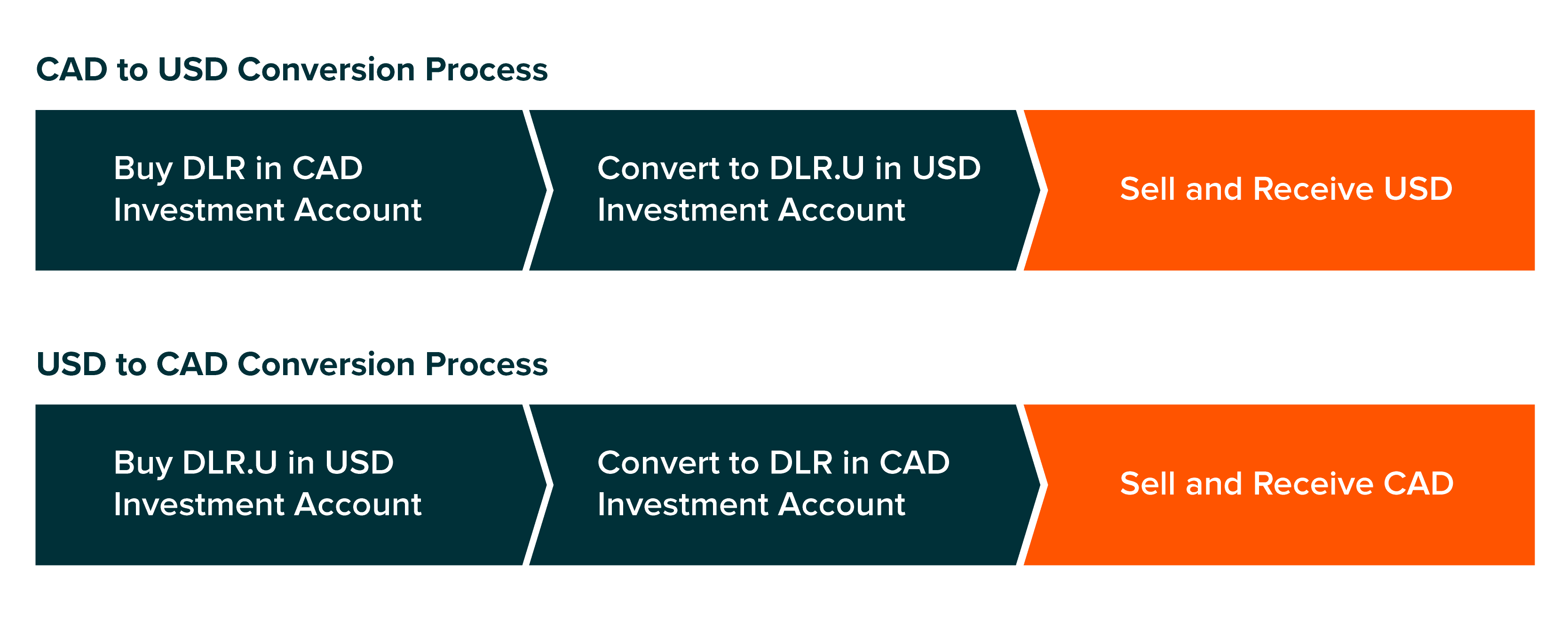

THREE SIMPLE STEPS TO ILLUSTRATE CONVERTING CANADIAN/U.S. DOLLARS USING DLR/DLR.U

Step 1 – Buy DLR

Ensure that you have both CAD and USD investment accounts with the same broker. Note, they will need to be the same type of account (i.e. cash or margin) and in the same registered name. Obtain a quote on DLR. Look for a reasonable bid-ask spread (generally, two cents).

If the quote and bid-ask spread is acceptable to you and you choose to proceed, the industry-recommended practice is to place a limit order at the current ask price. A limit order ensures that the trade will not be executed at a higher price.

Step 2 – Convert Units of DLR.U

Have your advisor or brokerage firm journal or transfer your DLR units from your CAD to your USD investment account. Your DLR units will become DLR.U units in your USD account. There is typically no cost associated with this transfer, however, some dealers may require three or more days for this step to settle.

Step 3 –Sell DLR.U and receive USD

Obtain a quote on DLR.U. Again, look for a reasonable bid-ask spread (generally, two cents). If the quote and bid-ask spread are acceptable to you and you choose to proceed, the industry-recommended practice is to place a limit order at the current bid price. Once the trade settles, you will have U.S. dollars in your USD investment account, which you can then allocate as desired. While this transaction could be more cost-effective than converting currencies into a bank account, investors should be aware that the value of their holdings may change over the course of the transaction. DLR investors are subject to the price movements of the U.S. dollar relative to the Canadian dollar.

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The Global X money market funds are not covered by the Canada Deposit Insurance Corporation, the Federal Deposit Insurance Corporation, or any other government deposit insurer. There can be no assurances that the money market fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the Funds will be returned to you. Past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Categories: Education, Insights

Topics: Currency, Fixed Income