Published May 1, 2024

What is a single commodity ETF?

An exchange-traded fund that invests in a physical commodity like natural gas, oil, silver or gold. A single commodity ETF can hold that particular commodity in physical storage or may invest in futures contracts.

Why would an investor want to hold a single commodity ETF in their portfolio?

It is considered to be a more efficient way to gain exposure to a specific commodity in an investment portfolio than investing in a commodity-producing company. Investing in a commodity-producing company could prove to be a poor proxy for the commodity and potentially expose you to the particular risks associated with that company.

Moreover, commodities tend to have a low correlation with global stock markets; not necessarily moving in the same direction or by the same magnitude as stocks. Adding commodities to your portfolio can potentially reduce its overall volatility.

Who should buy them?

An investor looking to hedge against inflation, or against certain currencies, as they can be a source of value during times of financial, economic and political uncertainty.

They can also appeal to an investor looking for additional diversification for their portfolio to offset stock market volatility. Commodities generally have low correlation with most global equities, meaning they do not necessarily move in the same direction, or by the same magnitude as stocks.

How do they work?

Global X’s single commodity ETFs are based on futures contracts. Futures contracts are rolled from their specified delivery month to a subsequent delivery month before contract maturity (when the holder of the contract would be required to accept or make delivery of a physical commodity).

What are the implications of contango and backwardation?

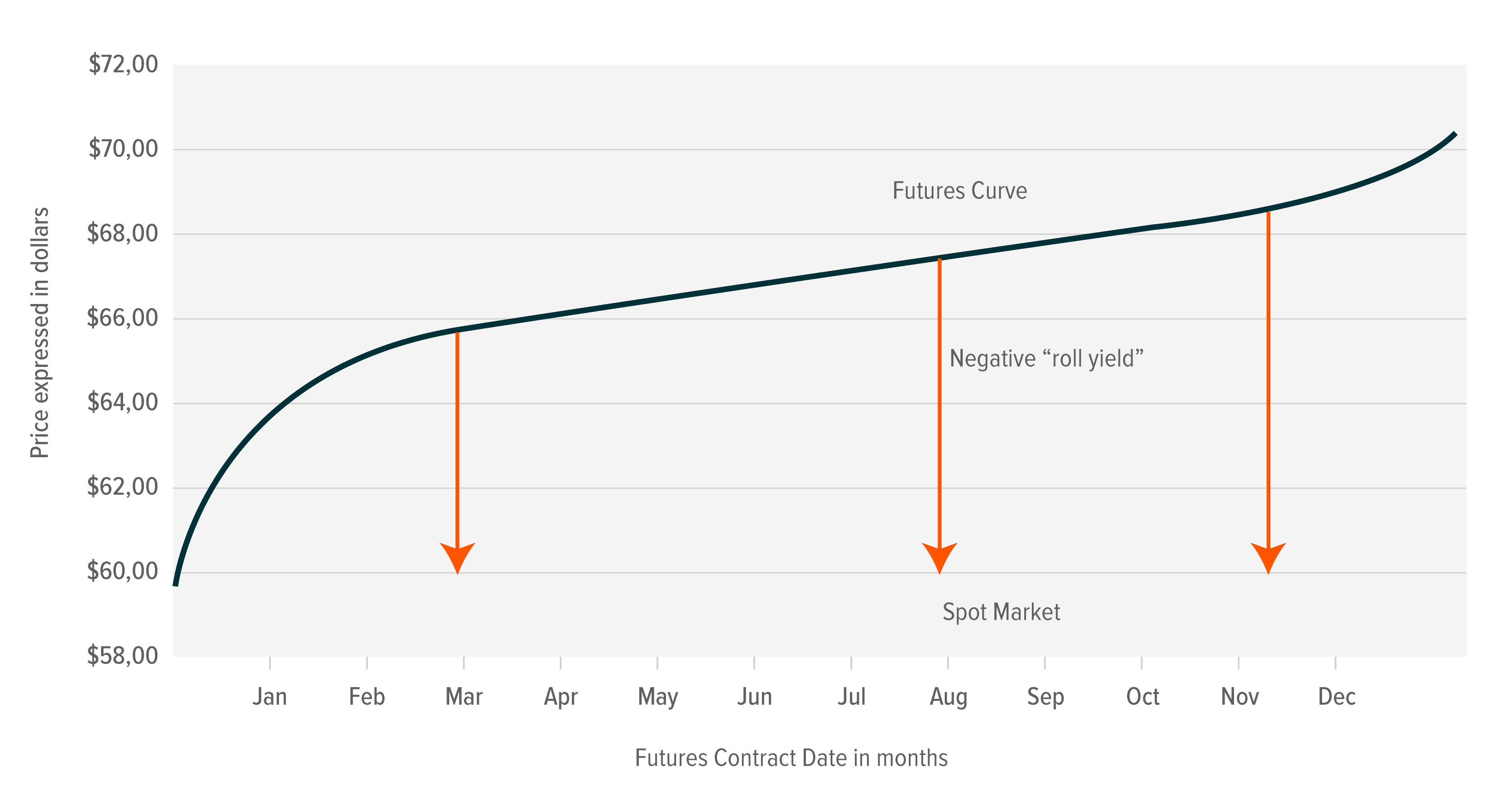

Contango is a condition in which the price of a futures contract is trading above the expected spot price at contract maturity, and the futures curve is upward sloping. In a contango environment, an investor who is in long futures may experience negative “roll yield” if the contract is rolled after the futures price moves downward to converge with the expected spot price (assuming an unchanged spot price at maturity). Even if the commodity appreciates, as predicted by the futures curve at the time of the investment, the investor holding long futures may experience a loss. Typically, investors would want to be in short futures if the futures curve is in contango, unless they expect the commodity to appreciate by more than what is priced into the futures curve.

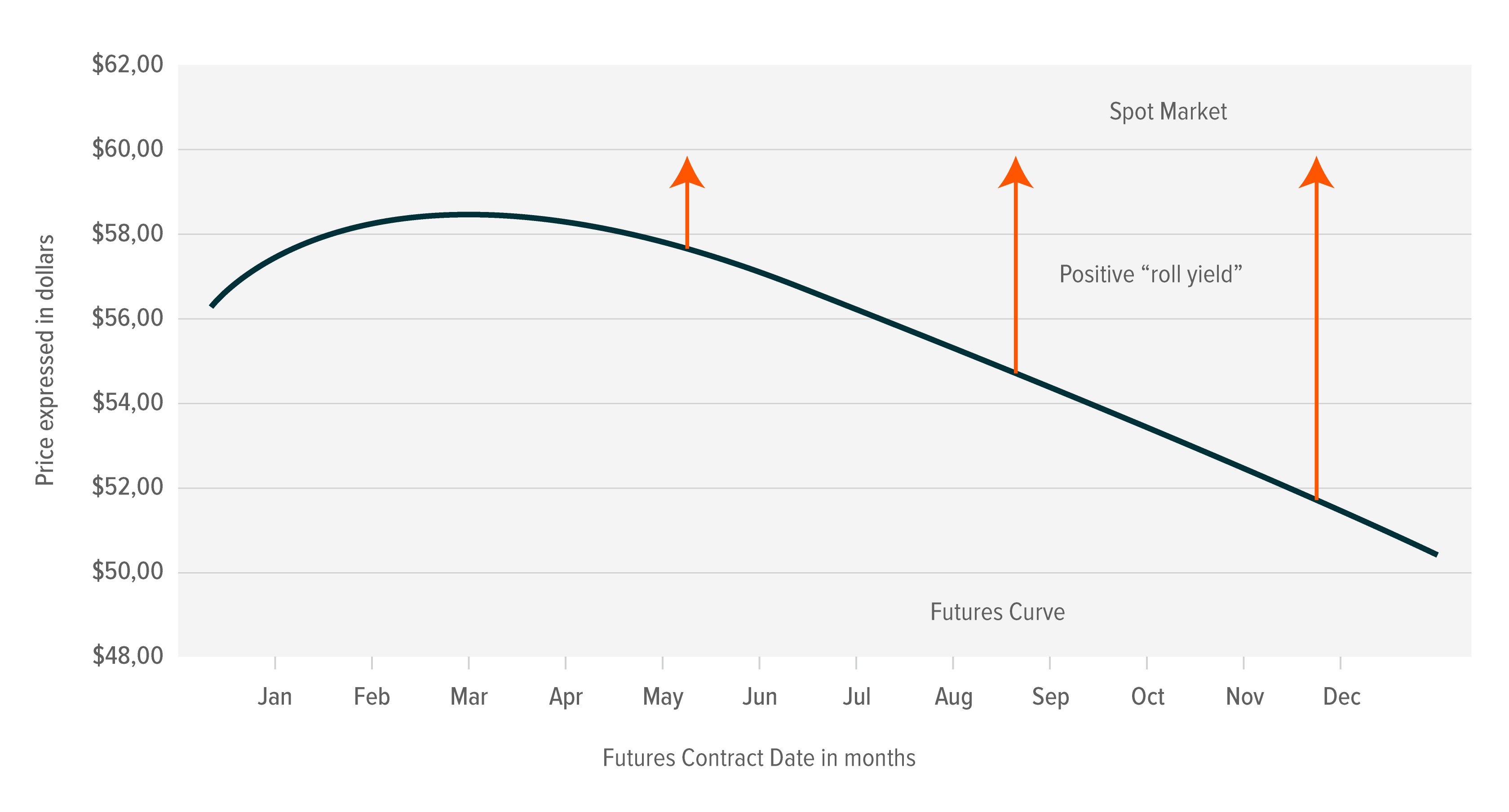

Backwardation is the inverse condition of contango, in which the price of a futures contract is trading below the expected spot price at contract maturity, and the futures curve is downward sloping. In a backwardation environment, an investor who is in long futures may experience positive “roll yield” if the contract is rolled after the futures price rises to converge with the expected spot price (assuming an unchanged spot price at maturity). Even if the commodity declines, as predicted by the futures curve at the time of the investment, the investor holding long futures may experience no loss. Typically, investors would therefore want to be in long futures if the futures curve is in backwardation, unless they expect the commodity to decline by more than what is priced into the futures curve.

Futures Curve in Contango

Futures Curve in Backwardation

GLOBAL X’s SUITE OF SINGLE COMMODITY ETFs

| Ticker | ETF Name | Management Fee* (%) |

| CARB | Global X Carbon Credits ETF (formerly Horizons Carbon Credits ETF) | 0.75 |

| HUG | Global X Gold ETF (formerly Horizons Gold ETF) | 0.20 |

| HUZ | Global X Silver ETF (formerly Horizons Silver ETF) | 0.65 |

| HUC | Global X Crude Oil ETF (formerly Horizons Crude Oil ETF) | 0.75 |

| HUN | Global X Natural Gas ETF (formerly Horizons Natural Gas ETF) | 0.75 |

*PLUS APPLICABLE SALES TAX

Global X Single Commodity ETFs attributes

- Trade on the Toronto Stock Exchange from 9:30 a.m. to 4:00 p.m. EST

- Currency hedged to the Canadian dollar

- Intraday liquidity

- Tax efficient

- Management fee* ranges from 0.20% to 0.75%

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The Global X money market funds are not covered by the Canada Deposit Insurance Corporation, the Federal Deposit Insurance Corporation, or any other government deposit insurer. There can be no assurances that the money market fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the Funds will be returned to you. Past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Categories: Education, Insights

Topics: Commodities